Dulles, VA February 26, 2024 – The following is a brief overview of Temu user stats and demographics in the US and UK:

Temu user growth plateauing

- Temu’s rapid rise in popularity saw its monthly active user numbers reach a peak of 17 million in the UK as of November 2023 and 83.2 million in September 2023 in the US.

- However, since then Temu’s user numbers have declined in both markets. In the UK Temu had 15.6 million monthly users as of January 2024, down 4% on the previous month and 8% from its peak. In the US Temu had 77.5 million users as of January 2024, down 7% from its peak.

- Despite these recent declines, which are common for most major retailers given seasonal shopping habits, Temu still remains one of the most popular shopping apps on the market with only Amazon exceeding it in terms of monthly active users.

Temu continues to be popular among women of all ages

- Temu’s users skew female in both US and UK markets, with around 62% female and 38% male users.

- Though the split between male and female users has remained roughly the same throughout Temu’s rise in the UK market, the gap has narrowed in the US. As of October 2022, 77% of all Temu users in the US were female. That figure is just 62% in the US today.

- When it comes to age, Temu’s users have been getting progressively older suggesting the enduring appeal of the app amongst older users.

- In the US, 18–24-year-old users hit their peak in June 2023 at 10.1 million but has since fallen to 8.1 million users as of January 2024. The share of users aged 55+ has been growing steadily over the past year, from 34% of Temu’s overall user base as of January 2023 (12.5m users) to 36% in January 2024 (27.6m users). Users aged 55+ make up the largest group in both UK and US markets.

- In the UK 18–24-year-old users peaked in May 2023 at 2.4 million before falling all the way to 1.5 million as of January 2024. Users aged 55+ hit a new peak in January 2024 at 4.8 million.

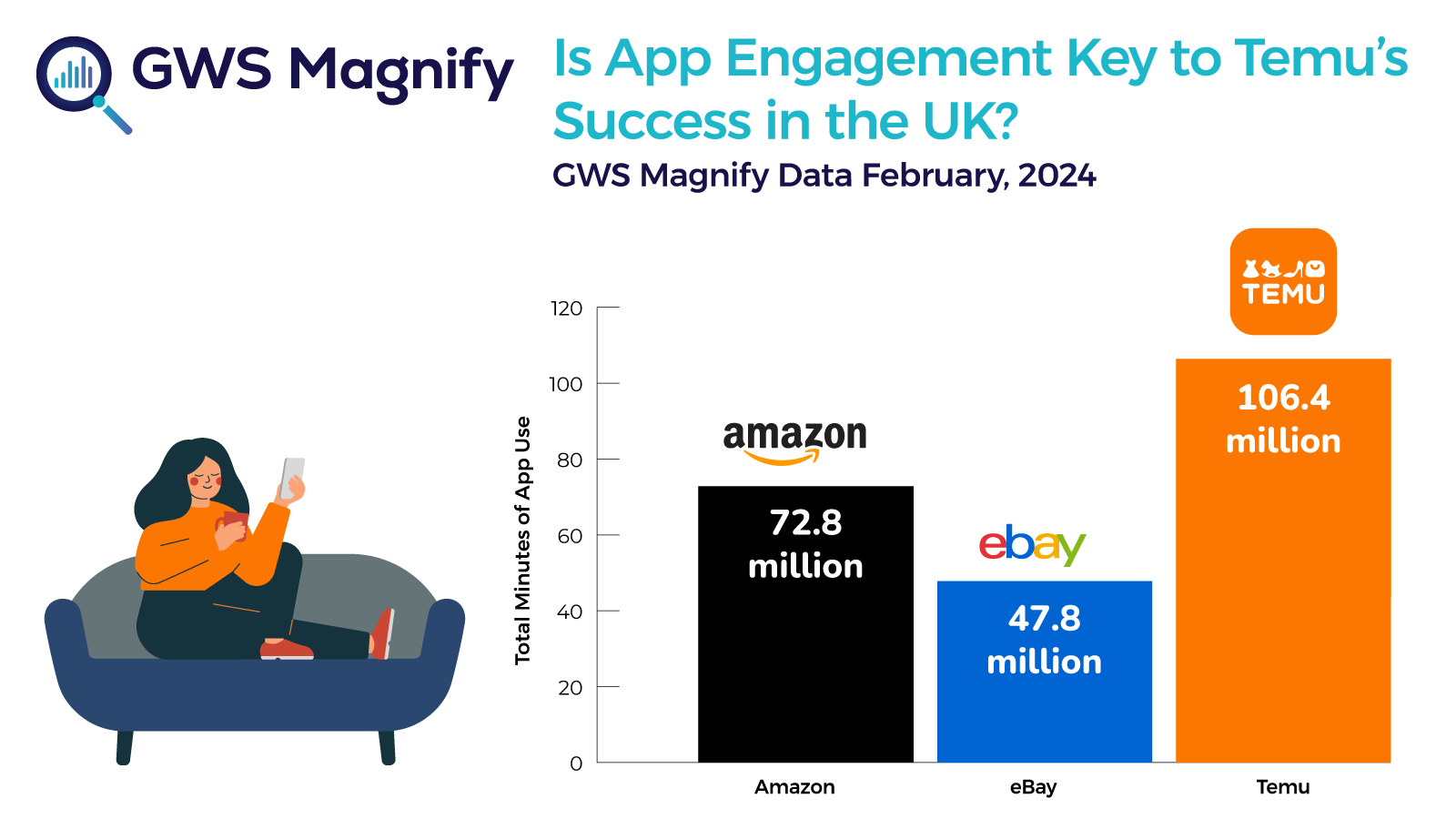

App engagement key to Temu’s success

- In the UK, users are currently spending significantly more time on the Temu app than other major players in mobile retail such as Amazon and eBay. Temu overtook Amazon in terms of total minutes of user for all users in August 2023. In February 2024 alone, users spent over 106.4m minutes daily on the Temu app, compared to 72.8m minutes for Amazon and just 47.8m for eBay.

- In the US, the total minutes across all users is still higher for Amazon than Temu, however, the gap is closing. As of February 2024, users spend 432.8m minutes daily on Temu and 493.4m on Amazon, even with Amazon’s higher user number.

- As such, in both the UK and US market the amount of time each individual user spends on the Temu app is significantly higher than for Amazon. As of February 2024 in the US, each individual user spent an average of 23 minutes per day on Temu compared to 11 on Amazon. In the UK in February 2024, Temu users spent an average of 21 minutes per day on the app compared to 8 minutes for Amazon

Comment from Dr Paul Carter, CEO, GWS: “Though Temu has not sustained the rapid rates of growth seen through much of 2023, its place amongst the major retailers in both US and UK markets cannot be disputed. Temu has built a significant user and resilient user base, with particular popularity amongst older women. Key to Temu’s enduring success is its clear focus on user engagement. The company has not just succeeded in securing user downloads and sign-ups, but encouraging long-term engagement on its app. Its intense focus on the customer journey and in-app experience has been central. From targeted offers to built-in gamified shopping features, users are rewarded from spending time on its platform. For Temu, the more time a person spends on its app, the more likely they are to make a purchase; thus, it is worthwhile investing in personalised rewards as a customer scrolls through its app. For any brand looking to follow in Temu’s footsteps, providing a proposition that keeps customers on an app while monitoring this activity via user engagement metrics is key to sustained success in the mobile retail space.”

Note: App engagement data was generated using Magnify, GWS’s mobile intelligence data platform. Magnify is comprised of key insights collected from consumers participating in our market research programs in the United States and United Kingdom. These are real-life consumers who use their mobile devices as normal throughout the day, so that the analytics data GWS gathers provides the most accurate picture of both the U.S. and U.K. mobile connectivity experience. In particular, data is anonymously collected from Android smartphones 24 hours a day, seven days a week, whenever and wherever the consumers use their devices. Data is reported in aggregate for market research purposes only. All information collected is weighted to a user’s demographic representation of each country’s adult population.

About GWS

For most consumers today, their mobile device is their life’s remote control. As an independent mobile insights consulting firm, GWS measures every aspect of how people live, work and play via their mobile devices – as well as how mobile network performance affects them.

Combining our market-leading network benchmarking technology and methodology with deep behavioral data, we help businesses and organizations to drive innovation and deliver better customer experiences through mobile insights, anywhere in the world. Championing the needs of mobile users by understanding and testing the things that matter to them, we’ve evolved our technology and services in step with the needs of industry and consumers for over 27 years.

GWS Media Contact Adam Hudson

[email protected]