Operators deliver speeds that satisfy majority of mobile users, as people spend 43% of screen time accessing social media and browsing apps

- Mobile network benchmarking specialist GWS has revealed that all of the UK’s major operators are hitting the ‘sweet spot’ with consumers satisfied with their everyday mobile network speeds ranging between 1-5Mbps

- The findings reveal that speed is not a key driver for people to move networks, with poor signal and blackspots ranking much higher than speed as a reason to change

- Brits are now spending nearly 5 hours a day (293 minutes) on their phones

- Social media and browsing currently account for over two-fifths (43%) of the total mobile screen time amongst UK adults. UK consumers spend over half (54%) of all daily mobile use on just 10 apps

London, 19 March – Mobile network benchmarking specialist GWS has revealed that the UK’s major operators are hitting the ‘sweet spot’ for customer network needs, with the majority satisfied with the speeds they are getting for their everyday mobile activities and not looking to change operator as a result.1

By combining real-life mobile usage analytics data with consumer polling, GWS has found that the network sweet spot, or the point at which consumer demands for network mobile speeds match what operators deliver, sits between 1-5Mbps. The data reveals that speeds in this “everyday” range allow the majority of UK mobile users to perform most of their mobile activity in ways they find satisfactory without the need for higher throughputs.

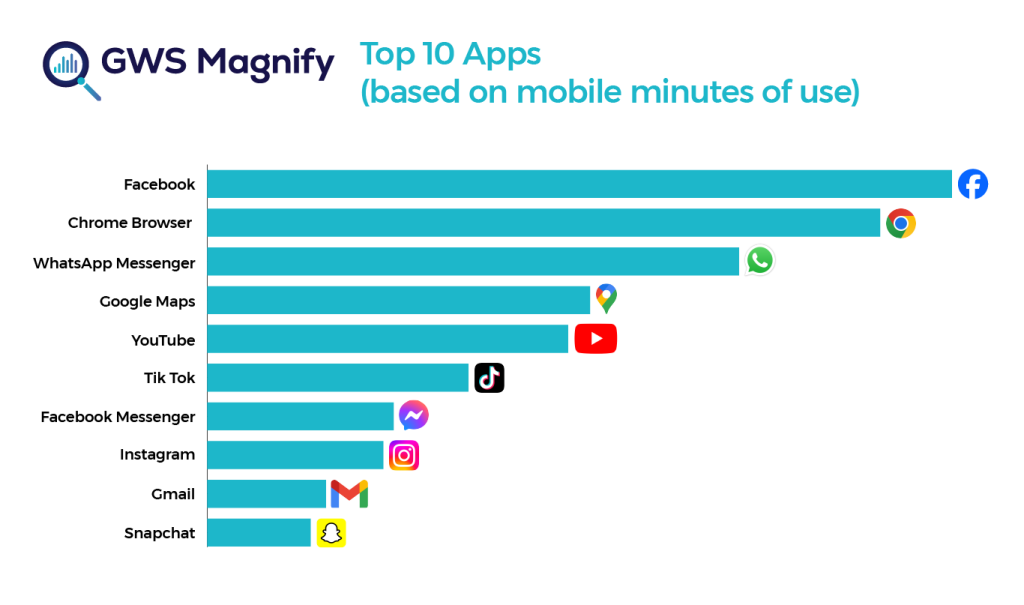

The results map mobile usage analytics trends tracked by GWS’ app analytics platform, GWS Magnify, which show that people are spending a large amount of time on social media, video, and browsing apps that can manage the everyday speeds provided by the operators. In fact, Brits are spending 43% of their daily mobile screen time on social media and browsing apps alone. The GWS Magnify data also highlights that people spend half of their daily mobile time on just 10 apps, accounting for 41 minutes (54%) of all mobile use per day in the UK, with Facebook at the top, followed by Chrome Browser, WhatsApp, Google Maps, YouTube, TikTok, Facebook Messenger, Instagram, Gmail, and Snapchat.

Dr Paul Carter, CEO of GWS commented: “Even though our network testing data shows that operators are capable of providing throughputs broadly averaging 45Mbps, which is more than ten times higher than the ‘everyday’ range required, the sweet spot we’ve found is much lower but still enables people to do what they need to while mobile. When it comes to how we use our phones, consumer demands are clear – they just want their phones to work when they want and for whatever activity they are doing. This doesn’t mean they need super high speeds all the time – in fact, the most popular activities require lower throughputs than you’d expect.”

Staying Connected – It’s a Big Deal

Can’t put the phone down: GWS’ real-life usage data reveals that Brits are now spending nearly 5 hours a day (293 minutes) on their phones – with over a quarter of their day spent ‘mobile’ (26%, or 77 minutes on mobile networks) and the remaining 74% (216 minutes) on WiFi networks. To put this into perspective, nearly a third of a consumer’s waking day (31%) is spent on their phones.

Are consumers focused on the task at hand or the tech at hand? When polling users on mobile network performance2, GWS found that over half of Brits (56%) said they did not mind whether they are receiving 4G or 5G coverage, so long as they could complete the task at hand. Even for the 44% that find 5G important, life still goes on for a majority of this group when they don’t get a 5G signal; meaning that they continue on with their tasks using whatever connection they have rather than wait until they are in 5G coverage.

A Loyal Nation of Mobile Network Users

Sticking with the plan: The study also highlights that most Brits (69%) are loyal to their network having been with their current operator for more than 2 years. While 29% are perhaps sticking to plan as they are locked into ‘long term contracts’, many are on more flexible deals: 31% are on ‘SIM only’ contracts, 20% on ‘rolling plans’, and 17% on ‘pay-as-you-go’. This means that the majority could change operators if they wanted to, but are choosing to stick.

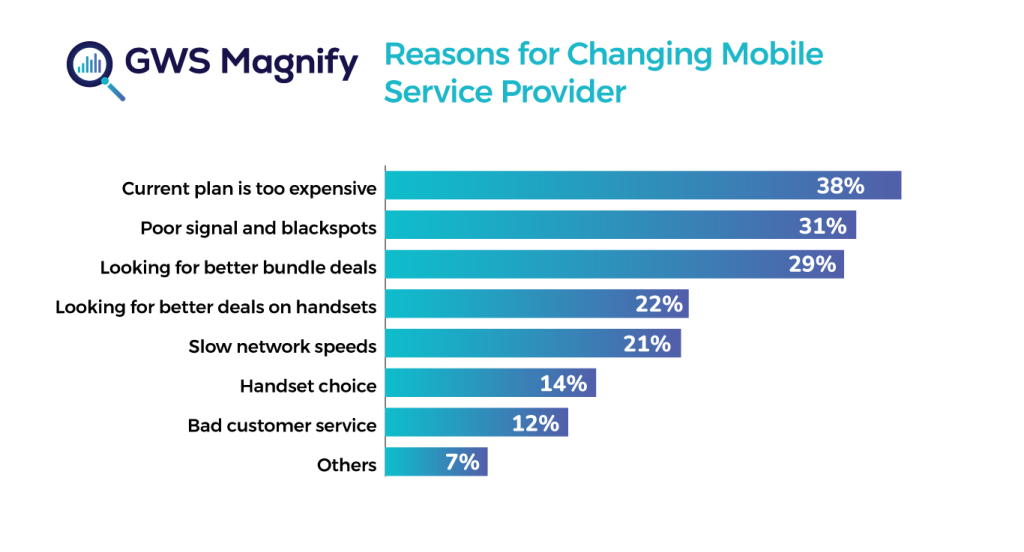

If I had to change operators, this is why: Whilst most people are happy with their current network, 24% of Brits are considering changing providers this year. Topping the list of reasons why they are contemplating a change is cost, as 38% feel their current plan is too expensive. After price, 31% say they are looking to change network due to poor signal and blackspots, and another 29% are looking for better bundle deals. Comparatively much fewer (21%) said they wanted to change due to slow network speeds.

Reliable coverage matters: The data shows that whilst operators are hitting the sweet spot when it comes to speeds, coverage reliability continues to be the primary network-related pain point for many with a majority of UK mobile customers (64%) reporting that they are still experiencing at least a few reliability issues a week. The importance of reliability has also been documented in previous GWS studies, noting that a reliable connection typically tops speed as the network factor most important to users.

Looking at the performance of the operators, Three registered the highest number of customers reporting frequent issues with their network coverage, followed by EE. Vodafone customers reported the fewest issues with their network coverage across the course of a week, followed by VMO2.

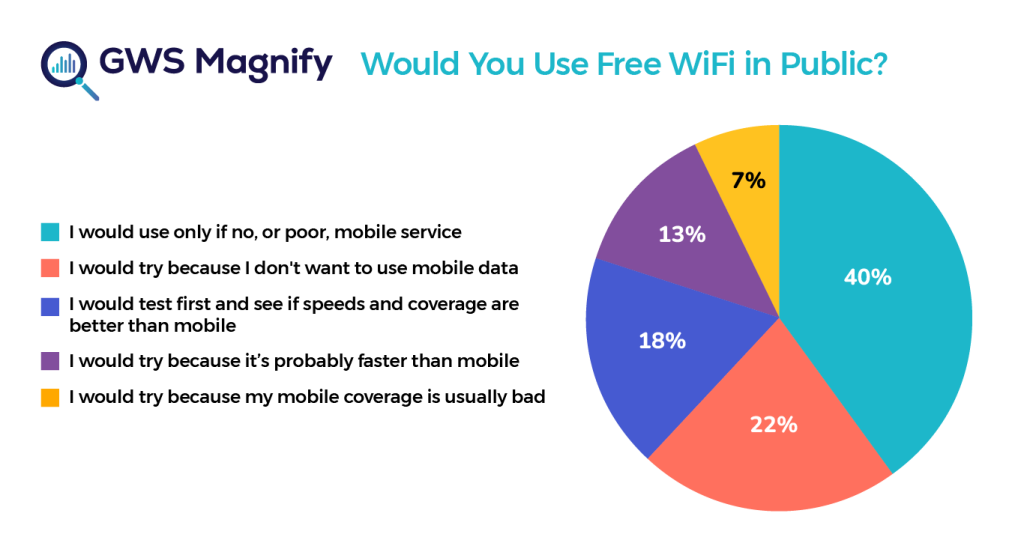

When out and about, mobile networks are a better option for consumers than public WiFi: Even if consumers experience some coverage issues with mobile networks, 40% will only use public WiFi as a last resort. In fact, only 22% will use a public WiFi because they are concerned about their mobile data usage and, just as significant, only 13% will use public WiFi because they think it’s faster.

Putting It All Together

Mobile operators have the ability to provide high throughputs to their customers (ten times higher than what they usually receive), but most of the time it doesn’t appear necessary as the apps people are using the most don’t require hyper-fast speeds to run. This is reinforced by the fact that consumers appear generally satisfied with their network service levels while receiving lower, everyday throughputs. In addition, they tend to be loyal to their operator switching primarily when the price is right not because the speed is too low. Furthermore, it is reliability, not speed, that is more important to British mobile network users. When people spend as much time as they do on their phones (1/3rd of their waking day), it’s about connecting with friends and family and doing whatever else is needed online without issue, and then moving on with their day.

Dr Paul Carter, CEO of GWS concludes: “Of course, delivering higher network speeds drives could drive a better experience and is important for certain activities, which will be increasingly critical in the future when 5G will have a very important role to play in everything from autonomous cars to telehealth. But the reality is that right now, we don’t need blazing-fast mobile speeds all the time for the ways that most people are currently using their phones throughout the day. Though there are areas for improvement, the fact that Brits are satisfied with networks is a testament to the innovation and investment in our mobile networks that operators are delivering to consumers for much of their daily mobile activities.”

Methodology

Data presented in this release is collected from a combination of the following sources:

1 Data sourced from Magnify, GWS’s mobile intelligence data platform. Magnify is comprised of key insights collected nationwide from consumers participating in our market research program. These are real-life consumers who use their mobile devices as normal throughout the day so that the analytics data GWS gathers provides the most accurate picture of the nation’s mobile connectivity experience. In particular, data is anonymously collected from Android smartphones 24 hours a day, seven days a week, whenever and wherever the consumers use their devices. Data is reported in aggregate for market research purposes only. All information collected is weighted to a user’s demographic representation of the U.K. adult population. Analytical data related to network performance and app engagement was collected during a six-month test period (7/1/23 – 12/31/23).

2 In addition to collecting network performance and app engagement data, GWS surveyed participating consumers to understand sentiment and perception via GWS Magnify. This survey was conducted during the month of January 2024, with a total response size of 2,951.

About GWS

For most consumers today, their mobile device is their life’s remote control. As an independent mobile insights consulting firm, GWS measures every aspect of how people live, work and play via their mobile devices – as well as how mobile network performance affects them.

Combining our market-leading network benchmarking technology and methodology with deep behavioural data, we help businesses and organizations to drive innovation and deliver better customer experiences through mobile insights, anywhere in the world. Championing the needs of mobile users by understanding and testing the things that matter to them, we’ve evolved our technology and services in step with the needs of industry and consumers for over 27 years.

GWS Media Contact

Adam Hudson

0207 291 0255

[email protected]