Dulles, VA April 29, 2024 – Last month when Truth Social went public, GWS provided a brief summary of Truth Social app engagement statistics. This month GWS did a deeper analysis of the Truth Social app including its performance and user base as well as how it compares to similar apps.

Truth Social Overview: Userbase, Growth, and App Performance

- In the US, the number of active mobile device users on Truth Social peaked at 1.1 million back in August of 2023, but then subsequently dropped below 500,000 by December 2023. (NB: these are users who accessed the Truth Social app at least once in a given month, as opposed to the total number of accounts or downloads).

- However, likely due to the increased media exposure following the SPAC deal, Truth’s monthly user numbers have risen through 1Q24, and have jumped in March, rising to 1.4 million, well above its previous peak.

- That said, these figures are still considerably lower than Reddit which had its IPO last month – Reddit had 46 million monthly active users in February 2024.

- Likewise, as of March 2024, X had 42 million monthly users compared to Truth’s 1.4 million.

- In terms of App ‘stickiness’, Truth Social is also much lower than other social media apps: The average user of Truth Social accesses the platform less than 2 days per week (1.8), compared to Pinterest (2.1 days), Reddit (3.3 days), X (3.6 days), Tik Tok (3.7 days) and Facebook at the top with 4.6 days per week.

- In addition, Truth Social also has a much lower user engagement than its social media competitors, with each user spending fewer minutes overall and engaging in fewer sessions on the app than its competitor platforms except for the freshly relaunched Parler.

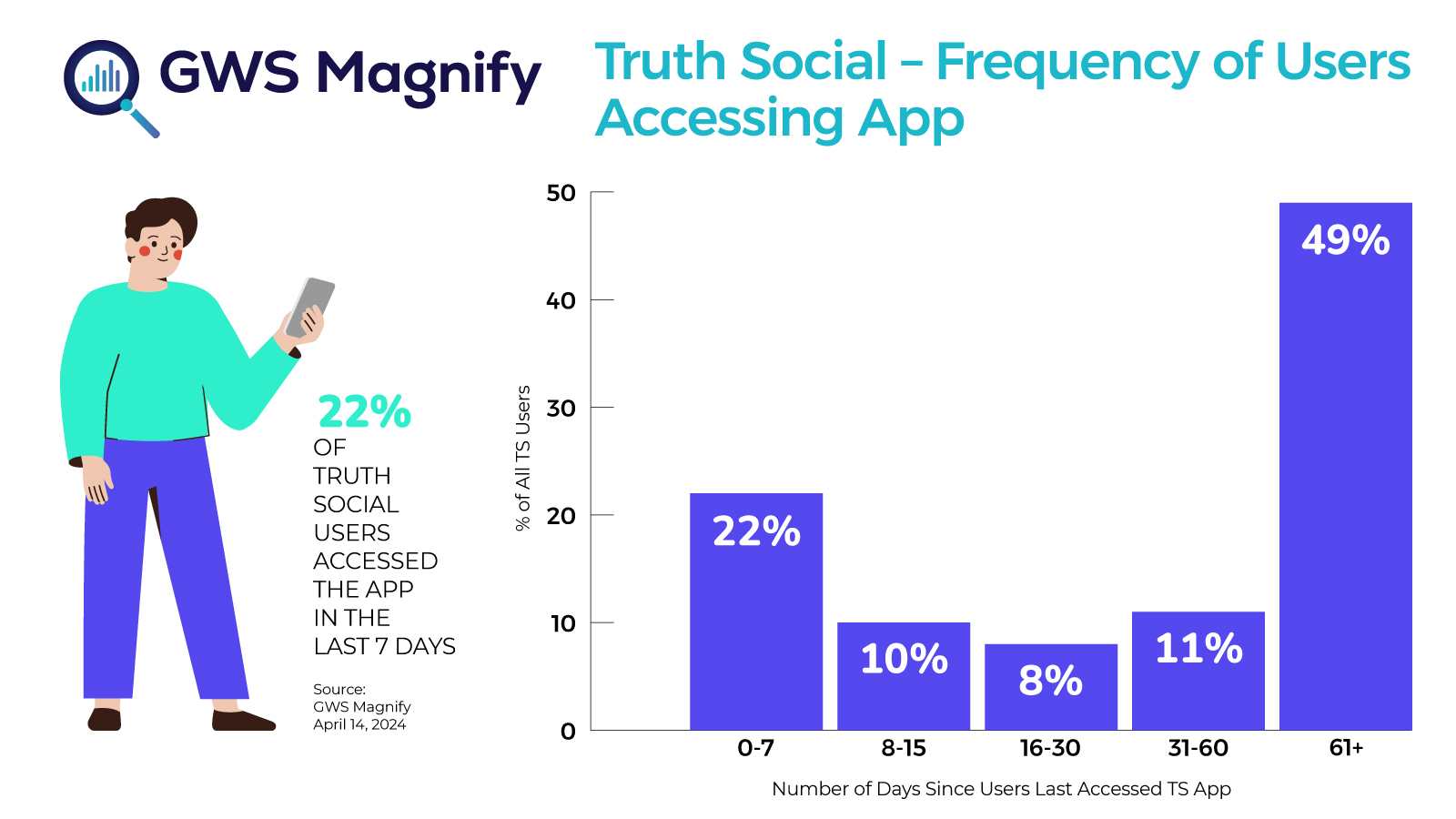

- Truth Social also has a retention problem in terms of users returning to use its app. At the time of analysis, just 22% of Truth Social users have used the app in the last 7 days, compared to 57% of X users. On the other hand, 49% of Truth Social users had not used the app for at least 61 days, compared to just 22% of X users.

Truth Social Users: Who are they and what other apps do they use?

- Truth Social is dominated by male users (as are X, Reddit, and Discord): More men use the app regularly than women, with 57% of active users being men and 43% women in February 2024

- Truth Social users see the greatest overlap with Facebook, followed by X:

- Overlap with X: 56% of Truth Social monthly active users also use X at least once per month (compared to just 19% of mobile device users who access X monthly) – showing a large overlap of users between X and Truth Social.

- Overlap with Facebook: Even higher is Facebook, which sees an 87% overlap between Truth Social users who also use Facebook on mobile devices. This is in contrast to Snapchat and Reddit, which are accessed by just 15% and 18% of Truth Social users respectively.

- One factor behind this overlap with Facebook is the age of Truth Social users which, like Facebook, skew older. As of March 2024, 65% of Truth Social users were over the age of 55, and 20% were aged between 45 and 54. Just 1% of Truth social users are aged between 18-24 and 4% are aged between 24-34.

- The average age of Truth Social users is also a point of differentiation from X users which are more mixed in terms of their age. Though the biggest age group for X users is the 55+ category (25%), 23% of users are aged between 25-34, and 19% are aged between 18-24 (which results in 5% of Truth users between 18-34, versus about 42% for X).

- In terms of race/ethnicity, 77% of Truth social users are White compared to 58% of X users. 16% of Truth social users are Hispanic (which, interestingly, has shown elevated numbers over the past six months), compared to 21% of X users. Just 1% of Truth Social users are Black, compared to 12% of X users (with X’s distribution mirroring closer to the national averages).

Comparing Truth Social: Microblogging Apps

- While the comparison with X might hold in terms of platform features (Truth Social essentially being an X clone), it is probably more accurate to compare Truth with smaller X challengers and microblogging platforms – the likes of Mastodon, Telegram, Parler or MeWe – which typically average under 1 million monthly active users.

- Compared to more established social media platforms, which see their monthly active user numbers consistently in the many millions each month, Truth is competing on a different terrain.

- With its recent growth in monthly users and significant press coverage, one might predict that it will establish itself as the dominant microblogging challenger platform. That said, its user base will always naturally be restricted to those on the right; or less speculatively, Truth is appealing to a very specific demographic audience at the moment (generally older White men) and there is no indication that this will change.

- Furthermore, although Truth Social now has more monthly users than some of its microblogging competitors, it has been susceptible to more variation in its user numbers. For instance, Truth Social registered 1.1 million users in September 2023, but that fell to just 449 thousand as of December 2023 before surging to 1.4 million in March 2024. The likes of MeWe and Telegram, on the other hand, have both been much more consistent in terms of the number of users registered.

- Another recent entry into the microblogging sphere, Threads, has finally started to show some promise. Threads floundered post-launch, falling from 10.3 million monthly users in July 2023 to just 7.8 million in August 2023. More recently, however, Threads has hit new highs in 4 consecutive months, with March 2024 reaching 12.5 million. However, despite the robust number of users, individuals don’t appear to be engaging much with the platform, averaging just over 2 sessions per day and 5-6 minutes of use per user, around the same as Truth Social.

Comparing Truth Social: Right Leaning Apps

- Another way to look at Truth Social is to compare it to other right-wing social media platforms: the likes of Rumble, Gettr, Parler

- As of March 2023, the video-sharing service Rumble was the largest of these alternative platforms with 1.7 million monthly users. Next was Truth Social at 1.4 million users, followed by Gettr at 175 thousand, then Parler with fewer than 50 thousand over each of the past few months.

- Due to it being a video-sharing site, as opposed to a microblogging platform, Rumble users also typically spend much more time on the app than its competitor apps. In March 2023 users spent 13.3 million minutes on Rumble each day, compared to just 1 million minutes on Truth Social or 620 thousand minutes on Gettr.

- In terms of driving consistent engagement amongst users, both Truth Social and Rumble saw issues with users downloading the app but not returning to it. 49% of Truth Social users and 56% of Rumble users have not used the app in the last 61 days. That said, both have a smaller core audience who do return regularly. 22% of Truth Social users and 20% of Rumble users had accessed the app in the last 7 days at the time of analysis.

Note: App engagement data was generated using Magnify, GWS’s mobile intelligence data platform. Magnify is comprised of key insights collected from consumers participating in our market research programs in the United States and the United Kingdom. These are real-life consumers who use their mobile devices as normal throughout the day so that the analytics data GWS gathers provides the most accurate picture of both the U.S. and U.K. mobile connectivity experience. In particular, data is anonymously collected from Android smartphones 24 hours a day, seven days a week, whenever and wherever the consumers use their devices. Data is reported in aggregate for market research purposes only. All information collected is weighted to a user’s demographic representation of each country’s adult population.

About GWS

For most consumers today, their mobile device is their life’s remote control. As an independent mobile insights consulting firm, GWS measures every aspect of how people live, work, and play via their mobile devices – as well as how mobile network performance affects them.

Combining our market-leading network benchmarking technology and methodology with deep behavioral data, we help businesses and organizations drive innovation and deliver better customer experiences through mobile insights, anywhere in the world. Championing the needs of mobile users by understanding and testing the things that matter to them, we’ve evolved our technology and services in step with the needs of industry and consumers for over 27 years.

GWS Media Contact

Adam Hudson

[email protected]